In a recent piece, I questioned whether cryptocurrency prices will ever fall to zero. I discussed the functions of Bitcoin, TerraUSD, and the economic pressures that drive the price of these cryptocurrencies. I concluded that the answer was no, but that there are a number of factors that can lead to a price decline. If the economic pressures are real enough, it may cause a price drop. What could trigger this drop?

Bitcoin’s functionality

Whether Bitcoins fall to zero is largely dependent on their functionality. While governments may require Bitcoin payments, people can choose not to use it as a means of exchange. Bitcoin’s functionality is a fundamental question that many skeptics are eager to answer. Bitcoin’s price will eventually drop to zero if the cryptocurrency is no longer useful. In the meantime, many people are arguing that it is overvalued and has very little utility.

A key question is whether Bitcoin will become a currency. This is because Bitcoin is too volatile to fulfill the functions of a currency. In this context, low volatility stablecoins have been created that aim to prevent cryptocurrencies from experiencing too much volatility while still preserving the benefits of blockchain technology. Some examples of low-volatility stablecoins include Tether, Griffin and Shams, and Libra.

The current bull run is often credited to institutional investors, who see this as proof that the cryptocurrency is here to stay. As a result, Bitcoin’s market cap is over one trillion dollars, and it would take a massive crash to send the price to zero. In order to send the price of Bitcoin to zero, it would have to lose 100% of its value, and a recent study published at Yale University found that the odds are less than one percent.

Bitcoin’s price

In the recent past, Bitcoin has gained enormous value, but some analysts question whether it will ever go back to zero. Many believe that this is simply a result of speculation rather than actual utility. Many Bitcoin enthusiasts argue that the price of Bitcoin is based on consumer confidence and that its increased popularity is monetary proof. Nevertheless, Bitcoin advocates are quick to point out that the price of Bitcoin does not have anything to do with its actual utility. The definition of currency is the efficient exchange of value. It tracks a weighted basket of goods and services.

If the Bitcoin price falls to zero, it would spell disaster for the cryptocurrency industry. Even if this scenario is unlikely to happen in the near future, it is possible for its price to fall significantly over time. Certain factors might decrease its value, but these factors would be too severe and sweeping to make it happen. In addition, it would require massive economic and governmental changes, and it would lead to the dismantlement of the Bitcoin network.

In early 2021, the price of Bitcoin reached an all-time high – over $60,000. As a result, there are some who claim that it will crash to zero. But this is an unrealistic expectation given its lack of underlying assets. However, Bitcoin has been on an uptrend for the majority of its existence. In less than a decade, it has gone from being worthless to more than $600,000. This has made it one of the world’s largest assets and the most lucrative asset in the history of the Internet.

Despite the recent drop, the cryptocurrency is still growing in popularity and represents the lion’s share of the entire cryptocurrency sector. A recent survey revealed that Bitcoin’s price dropped to $25,500 this week, which is just half of its record low in November last year. A new trend is emerging in the crypto industry – yield-based products that offer fixed interest rates to investors will be more popular in the future.

TerraUSD’s price

The meteoric rise of Terra has made its major investors question the project’s viability, and it’s not clear how the coin will survive its inevitable crash to zero. Some of them have kept quiet about their involvement, while others have even gone as far as getting tattoos of Luna on their shoulders. If you’re new to blockchain, the explanation is a little confusing. But we’ll break it down for you anyway.

Despite the hype, a recent fiasco has damaged the value of Terra coin. The unstable Terra coin could render Terra coins worthless, burning tens of thousands of investors. It’s no wonder investors have lost faith in the company, as the Terra coin is a total Ponzi scheme. While there are other crypto assets, stablecoins are viewed as safe places to store cash, because they don’t interact with the traditional financial system. They also function as a medium of exchange, allowing users to store money on blockchains without worrying about the monetary value.

While TerraUSD’s update aims to correct the problem, we’re not sure it’ll be enough to restore stability. If it doesn’t, other popular stablecoins such as Tether and USD Coin could be affected, too. This is not good optics for the crypto industry, which has already been shaky due to this year’s massive sell-off. Regardless, we’ll see if TerraUSD’s price is stabilized in the future.

The price of the terraUSD is likely to drop to zero in the coming months. The UST dropped to $0.2998 on 11 May. The Luna Foundation Guard, which runs the Terra ecosystem, has recently cut the supply of Terra UST, in a bid to re-peg the coin. However, the price fell below the $30,000 threshold on 9 June 2022, and has since fallen to zero.

Economic pressures

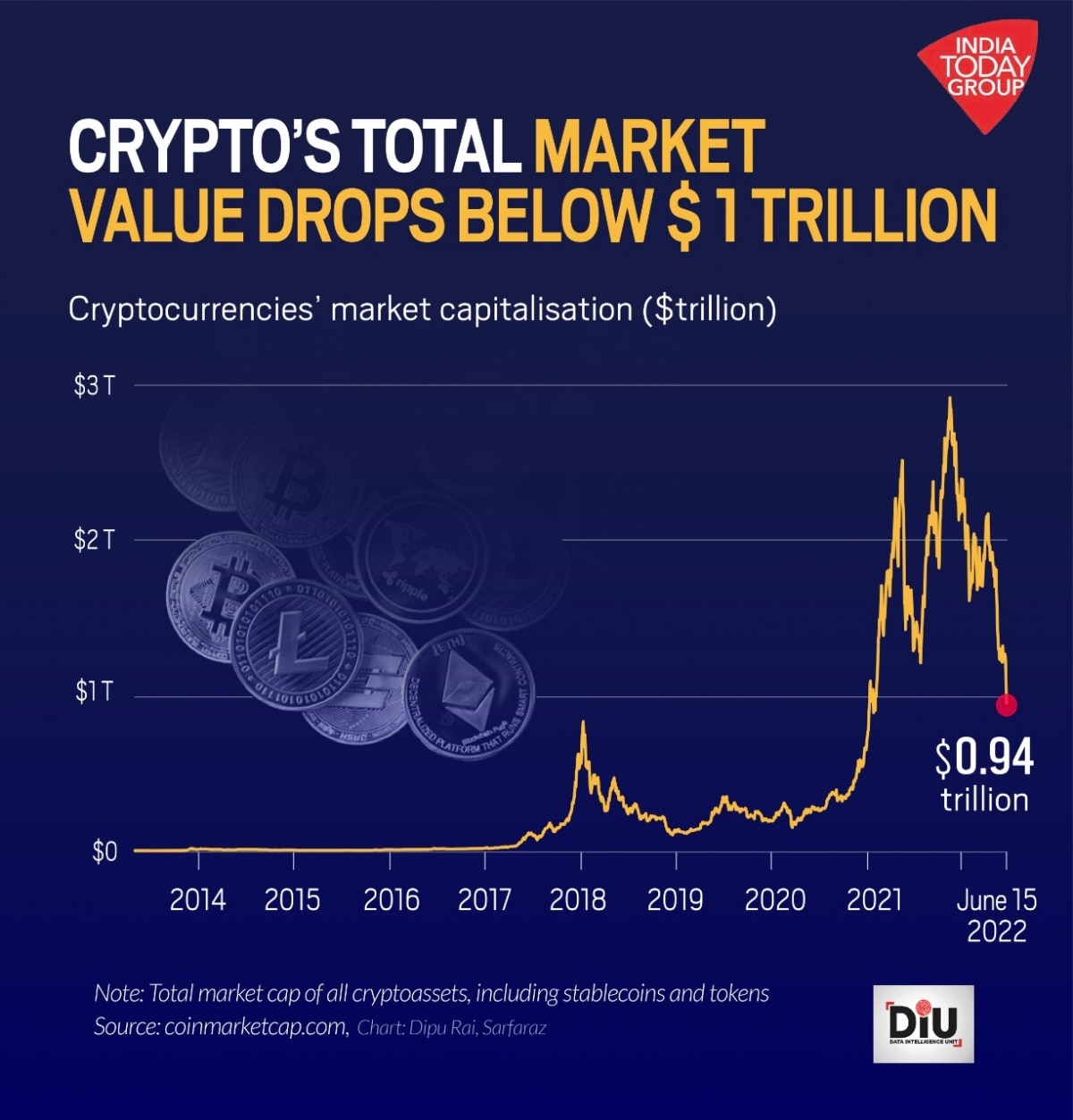

The soaring price of cryptocurrencies is creating a risk-averse environment, despite the fact that the market is under $1 trillion, and is far below the market cap of Apple. According to Goldman Sachs, U.S. households currently own a third of the global crypto market, putting them at risk if the trend continues. In fact, a recent Pew Research Center survey found that 16% of U.S. adults have either traded or invested in cryptocurrency. That means that nearly every household in the U.S. has some exposure to the crypto market sell-off.

China has banned bitcoin as legal tender to curb money laundering, while Brexit has hurt the pound’s value by 10%. Uncertainty over global and local economic policies has also contributed to the price of BCP. It has been a year of volatility for BTC, but compared to other cryptocurrencies, the price has remained relatively stable, falling by about 54% since January this year. The recent spike in GEPU may be a cause of some of the market spillovers.

While the underlying economic drivers of BitCoin prices have small effects in the short run, the impact of other factors, such as investment attractiveness and exchange rate, is quite large. In fact, the impact of the Dow Jones on BitCoin prices is statistically significant in both periods, but not for the long term. In fact, the impact of the price of BitCoin on the broader economy is largely due to the underlying attention-driven investment behavior of investors.

The underlying technology of Bitcoin makes it a popular digital currency, attracting investors worldwide. The value of bitcoin has reached $160 billion as of July this year. The central bank of Finland has said that it cannot be regulated by a government because the technology is self-regulatory. This opinion is a personal one and does not affect the editorial content. But it is important to note that the team of Futurism consists of personal investors in cryptocurrency markets.

Increased regulation

A new crypto regulation could be a positive step. It could slow down people who are looking to make money quickly by predicting the price of a particular cryptocurrency. At the same time, it could bring more long-term investors into the cryptocurrency market. Despite all of the hype surrounding crypto, it’s difficult to know whether more regulation will help the market or only hinder it. As long as there aren’t too many regulations, enthusiasts can only speculate.

The S.E.C. is particularly interested in Coinbase, the biggest cryptocurrency exchange. In June, the company announced a product called Lend, which would allow individuals to loan their cryptocurrencies to other users. These companies would collect interest from the borrowers and pay them back in cryptocurrency. On September 7th, Coinbase announced that it was being investigated by the S.E.C. It claimed the offering involved security. Coinbase executives engaged in discussions with the S.E.C.

The lack of regulation has been blamed for the recent decline in the prices of crypto. Lack of regulation in the crypto industry has also created an environment for widespread fraud and scams. The resulting market volatility has created a huge number of problems for investors. And even though it’s not entirely impossible to avoid such issues, the crypto market is prone to manipulation and is a risky investment. Therefore, increased regulation is inevitable.

New cryptocurrency regulation is seen as an important step toward mainstream acceptance. New government regulation of digital assets like Bitcoin, Ether, stablecoins, and nonfungible tokens may provide legitimacy to the industry. As the crypto market matures, the regulatory framework could bring more innovation and mainstream acceptance of these digital assets. Rishi Khanna, CEO of Stocktwits, says that crypto regulation could provide comfort for those skeptical of the market.